.

Cotton shortage hampers Textile sector earning

.

![]()

Ethiopia had hoped to generate USD 350 million from textiles and garments last year. However the nation’s efforts were hampered from the low supply of cotton, power interruption and other outside challenges. In reality garments and textiles earned USD 111 million which is 31 percent of what they had hoped.

Investors are saying that there is not enough supply of cotton to meet demands. They also hope that educational institutions will focus on the industry so that more qualified textile professionals emerge.

During a meeting with stakeholders in the textile industry at Capital Hotel on October 8, Ahmed Abtew, Minister of Industry, said the government has been doing many things to help the textile industry flourish. He pointed out that three years ago the country earned USD 65 million USD but currently the textiles and garments have brought in USD 111 million.

He added that the fact that many investors do not have enough skills and low agricultural supply are other factors. The country plans to earn USD one billion from textiles at the end of the Growth and Transformation Plan (GTP), however, in the past four years it has earned USD 435 million .

When the GTP began the idea was to increase textile manufacturing companies by 48 when the GTP sunset in 2015 but currently there are 33. Seleshi Lemma, Director General of the Textile Industry Development Institute added that the cotton supply is something that really need to be addressed. He also added that companies should begin working when they say they will.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4632:cotton-shortage-hampers-textile-sector-earning-&catid=35:capital&Itemid=27

.

Sugarcane farmers use beetles to tame pest

.

Written by Julius Omondi for Farmbizafrica

![Sugar cane cuttings with white scale infestations. The black tiny patches are larvae of the beetle(bio predator) introduced in the cane and is already feeding on the white scales. Photo/farmbizFILES]()

Sugar cane farmers in Uganda are using specially bred beetles to tame the voracious white scale pest that has robbed farmers off any harvest because of their destructive nature on sugar cane.

The innovative mode of scientifically wiping out the pest was discovered and introduced among cane farmers by Dr. B. Ramesh an entomologist from Kinyara Sugar factory. The budding scientist who joined the company in 2010 found the pest a major menace in both out grower and company plantations. “Generally farmers were no longer interested in cane farming due to the losses accruing from the pest and this prompted my quick intervention,” noted Dr. Ramesh.

While on a field research, the scientist realized an outstanding observation in one of the affected cane. The cane which was affected by white scales had an internodes section that seemed to be clearing up of the pests. He took the sugar cane to the laboratory for further analysis and realized that there was a beetle (bio predator) feeding on the pest. According to him, the discovery of a bio predator was a milestone in the fight against the destructive pest. Initially the company had tried to apply the use of chemical spray which was unhealthy as well as not attainable. “In order to control the white scale using chemical, the sprayed chemical has to mix with sap in the plant for the pest to suck and eventually die. Ultimately, this means contaminating the cane hence rendering the whole procedure useless,” explained Dr.Ramesh.

Out of the 110 days of the life cycle of a beetle, the larvae stage takes about 25-30 days of the cycle period. During this stage, the larvae exclusively feed on the white scales of the sugar cane. Dr. Ramesh scientist then embarked on mass rearing of the beetle in order to use them to control the pest. The company gives out grower farmers the bio predator for free as part of their Corporate Social Responsibility.

The larvae are introduced in the sugar cane plantation at an interval of 15 days. Sugar cane cuttings from the laboratory laced with the larvae are introduced at various points of the plantation and the larvae then move into the canes in search of their food which is the sugar cane white scales pest. The larvae feed on the white scales relieving the cane of the menace and offering farmers a life line on their investment returns. One hectare of sugar cane plantation is introduced with about 250 grams of the beetle larvae.

White scale pests usually establish on internodes covered with leaf sheath. The leaves of infested canes show signs of tip drying and unhealthy pale green colour and with continued infestation turn yellow. Desapping leads to non-opening of leaves also, which also turn yellow and finally dry out. Nodal region is more infested than internodal region. In the case of severe infestation, the cane stalks are almost entirely covered by scales. When gravid, the female’s body is 1.8 mm long and 0.9 mm wide.

After egg-laying, the female shrinks and loses her pink colouration. Eggs are laid under the females scale. Upon hatching the crawlers which are young immature mobile stage wander looking for a feeding site. They insert their needle-like mouthparts and suck plant sap and do not move again.

The white scale is a serious pest of sugarcane causing yield loss both of canes and sugar content and making extensive replanting necessary. Yields losses of over 30percent percent have been reported in Tanzania while some farmers in Masindi area had reported 100 percent yield loss prior to the introduction of the bio predators. Infested crop losses its vigour, canes shrivel, growth is stunted and the internodal length is reduced drastically. Ultimately cane dries up. Such canes when slit open appear brownish red. Thus yield and quality suffer. The yield loss could range from negligible to total crop failure.

According to Dr. Ranesh, water logging, high temperature and humidity favour buildup of scale insect population. Rainwater and high wind velocity facilitate dispersal of the pest. It spreads to new areas through seed material. Men and animals passing through the infested fields also lead to spread of the pest to the adjoining areas.

http://www.farmbizafrica.com/index.php?option=com_content&view=article&id=1362:sugarcane-farmers-use-beetles-to-tame-pest&catid=19&Itemid=142

.

Africa must reform energy sector to boost growth

.

![greenpower]()

LONDON: Sub-Saharan Africa’s energy sector needs overhauling to help power its economic and social prosperity, instead of being an obstacle to its development, the IEA said.

The International Energy Agency, unveiling its first-ever Africa Energy Outlook at a London press conference, said increasing access to modern forms of energy was critical in a region where two thirds of the population — or 620 million people — currently live without electricity.

“A better functioning energy sector is vital to ensuring that the citizens of Sub-Saharan Africa can fulfil their aspirations,” said IEA executive director Maria van der Hoeven.

“The energy sector is acting as a brake on development, but this can be overcome and the benefits of success are huge.”

The Paris-based IEA, energy watchdog to the world’s industrialized nations, added that almost 730 million people in Sub-Saharan Africa relied on dangerous and inefficient forms of cooking, with solid biomass — fuelwood and charcoal — outweighing all other fuels combined.

Van der Hoeven told journalists in London that Africa’s energy sector needed to become “a driver rather than brake” to economic growth.

The organization concluded in its report that Africa’s energy resources were “more than sufficient” to meet the population’s needs, but also identified three specific recommendations.

The IEA called for an extra investment of $450 billion (355 billion euros) in power generation, in order to halve power outages and gain universal access to electricity in all urban areas.

It urged deeper regional co-operation and integration, which would enable large-scale power generation and transmission, and stimulate cross-border trade.

The agency also appealed for better management of energy resources and revenues in the region, with “robust and transparent processes” to encourage more effective use of oil and gas revenues.

These three recommendations would help boost Sub-Saharan Africa’s economic growth by almost a third by 2040, according to the IEA.

It estimated that they would deliver an additional decade of growth in per-capita incomes by 2040, while the proposals would also bring electricity to an extra 230 million people.

“Poor electricity infrastructures is a major barrier to economic and social developement in the continent,” added the IEA’s chief economist Fatih Birol.

“Currently if there are $3 invested in the energy sector in sub-Saharian Africa, $2 go to the project which exports African energy to other continents (Europe, North America, Asia) and $1 goes to provide domestic energy services to the Africans.”

He added: “600,000 people die every year prematurely because of the indoor pollution created by use of biomass for cooking — and this is the second cause of premature death in sub-Saharian Africa after AIDS.”

.

Annual conference focuses on the importance of intra African Trade

.

![au]()

The annual Regional Strategic Analysis and Knowledge Support System (ReSAKSS) conference was held this week at the African Union Commission from October 8 to 10.

The conference’s main discussion included the importance of improved agricultural trade performance and competitiveness to enhancing the resilience of the poor and vulnerable.

“Equitable and sustainable agriculture and rural development in Africa requires strategic investments in agriculture, natural resources and the social sector in order to enable rural communities to engage in dynamic and rewarding economic activities,” stated Professor Tekalign Mamo, State Minister of Agriculture in his opening remarks.

The decision made by African Heads of State in Maputo, Mozambique last year where it was agreed that governments should spend 10 percent of national budget for the development of agriculture, was an essential milestone in the African economic transformation. The decision put agriculture as the engine of growth for African nations to address food security and poverty alleviation programs, he said.

Ethiopia has been one of the leading countries in allocating an adequate budget for agriculture and that along with other strategic interventions, it has helped the country to register significant annual agricultural growth over the past 10 years, he added.

According to Tumusiime Rhoda, Commissioner for Rural Economy and Agriculture, during the Maputo conference, African governments also agreed to boost intra-Africa trade in agricultural commodities and service and enhancing resilience of livelihoods and production system to climate variability and other risks.

“The pursuit and achievement of these goals will also be in line with the theme of the just concluded 50th Anniversary of the OAU/AU, which is Pan Africanism and African Renaissance. It is also part of the Africa Agenda 2063 on the Africa We Want,” Rhoda stated.

During the ReSAKSS conference held this week, the delegates discussed countries’ progress toward evidence-based policy planning and implementation through the establishment and operation of Strategic Analysis and Knowledge Support Systems (SAKSS) platforms as well as the strengthening of mutual accountability through regular and comprehensive agriculture joint sector reviews.

Studies show that Africa’s agricultural export accounted for 3.3 percent of the world’s agricultural trade in 2009-2013, which is an increase when compared with previous years. The share of intra-African trade has also doubled. Currently, nearly 34 percent of agricultural exports originating from African countries go to other African countries.

“While the situation is far different from that of the 1960s, when African countries dominated global markets, the recent performance indicates that Africa can become a major player again. Now countries need to sustain the policies and institutional reforms and scale up the investments that made this change possible,” said Ousmane Badiane, Director for Africa at the International Food Policy Research Institute (IFPRI).

Studies also show that, fueled by both economic growth and population growth, agricultural imports have increased significantly faster than exports. As a result, the agricultural trade deficit rose from less than USD 1 billion to nearly USD 40 billion.

“This highlights the tremendous challenge facing African countries and the need to deepen the reforms and scale up the efforts that have accelerated exports over the last 10 years,” conference participants stated.

The conference was organized by the African Union Commission (AUC), in partnership with the International Food Policy Research Institute (IFPRI).

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4627:annual-conference-focuses-on-the-importance-of-intra-african-trade&catid=54:news&Itemid=27

.

Large Quantity Importers to Benefit from Door-to-Door Delivery Service

.

- The new system will enable manufacturers to pay tax as they use their products, rather than paying for all stocked commodities

![]()

The Ethiopian Shipping & Logistics Services Enterprise (ESLSE) is delivering shipments directly to the warehouses of large quantity importers who import full containers, in an arrangement with the Ethiopian Revenues & Customs Authority (ERCA).

.

The decision followed what the Enterprise called a successful pilot in September for factories at the Easter Industry Zone, which has a bonded warehouse – a requirement for the service.

This approach will mitigate the cargo congestion problem at the dry ports and enable manufacturers to receive the imported cargo on time, says Ewnetu Taye, Director of multimodal services at the ESLSE.

The multimodal system started in 2012, with a directive from the Ministry of Transport (MoT) to transport goods under a single contract, but with two different means of transportation. The carrier is liable for the entire journey, including the shipment’s delivery at the final destination. The transportation can be performed by sea, rail and or road.

The directive instructed all government shipments transported through the ESLSE to be delivered to dry ports and warehouses that are authorised by the ERCA to receive shipments. All private importers are also ordered to bring their container shipments to the dry ports and warehouses of the ERCA.

But the system faced problems from the outset, leading to the reintroduction of the uni-modal system within the same year. The Enterprise had organisational and management problems in facilitating the multimodal system, says an official at the Modjo Dry Port.

After some adjustments, the Enterprise restarted the multimodal service, transporting cargo from Djibouti to the Modjo Dry Port – 72km from Addis Abeba – and to the Comet Transport SC located in Kality. The cargo are moved to importers warehouses after tax clearance.

For the latest door-to-door delivery of containers, importers need a license for bonded warehouses – a building or other secured area to keep the imports. This arrangement allows manufacturers to clear taxes at their warehouses, only for the amount of the imported goods they have used – not all at once for all stocked commodities at the warehouses – according to Ewnetu.

“For this type of tax clearance, the importers should get a permit from the ERCA,” said Ewnetu.

A leather factory executive says that the new approach will not only cut the delivery time for shipments, but also the costs of transportation to their warehouses, as the Enterprise could hire transporters that offer low prices.

http://addisfortune.net/articles/large-quantity-importers-to-benefit-from-door-to-door-delivery-service/

.

Ethiopia’s foray into Int’l capital market – lessons from Africa

![Business-in-Africa-150x150]()

For the most part, African countries long have had to rely on foreign aid or loans from international financial institutions to supply part of their foreign exchange needs. When compared with other emerging regions, Africa is the most dependent on multilateral and bilateral financing. At the end of 2011, those two sources jointly accounted for more than two thirds of public (and publicly guaranteed) external debts in Africa. In fact, half of African countries have no alternative way of accessing external financing.

Official donors’ flows are now on a declining trend in real terms as the ongoing financial crisis have pressed donor governments to tighten their budgets. African countries would also like to reduce dependence on the usual aid providers and attain policy independence and finance projects that such donors have been unwilling to fund.

Now, for the first time many of them are able to borrow in international financial markets, selling mainly Sovereign bonds. A Sovereign bond is a debt security issued by a national government. Known as a Eurobond, is denominated in a foreign currency (usually the dollar, rather than, as its name would suggest, the Euro). Still only 14 out of 54 countries have been able to issue Eurobonds on international markets, in part because the process is rather complex. In addition, many countries remain unrated and are still subject to political instability.

What is new?

The developed world has been rocked by a succession of economic and financial crises while Africa has maintained solid growth over recent years, averaging about 5% per annum. The chief global economist at Renaissance Capital estimates the economy of Sub-Saharan Africa to grow 15-fold over the next 35 years; from $2 trillion to $29 trillion. Hence, they have considerable infrastructure necessities — such as electricity generation and distribution, roads, airports, ports, and railroads, which often require resources that exceed aid flows and domestic savings.

For many African governments, Eurobonds are a means of diversifying sources of investment finance and stirring away from conventional foreign aid. Not only do these bonds allow such governments to raise money for development projects when domestic resources are lacking, they also help reduce budgetary deficits in an atmosphere in which donors are not willing to boost their development assistance. In addition, bond issuances come with fewer strings attached than money from multilateral institutions. Governments also have more control over where they direct the money.

Changes in the institutional environment, reduced debt burdens, large borrowing needs, and Low borrowing costs are some of major factors propelling the burgeoning bond sales. Reduced debt burden also allows countries to borrow in international markets without straining their ability to repay. (The median government debt–to-GDP ratio in SSA is below 40%) In addition, many countries have strengthened their macroeconomic management and improved their ability to measure debt sustainability. Sovereign credit ratings, which are a good measure for the creditworthiness of a country, capture factors like a country’s sustainability of its external financial operations, the ratio of external debt to exports; and macroeconomic stability (mainly measured by inflation performance).

Analysts credit this surge in borrowing to factors such as rapid growth and better economic policies, low global interest rates, and the economic stress in many advanced economies, especially in Europe. In several cases, African countries have been able to sell bonds at lower interest rates than distressed European economies like Greece and Portugal could. Although borrowing costs are historically low, yields of Eurobonds from Africa are high enough to draw foreign investors.

African Eurobonds

![eurobond eurobond]() Attracted by the prevailing low interest rates, cash-strapped African countries looking to borrow money on international private markets are increasingly turning to Eurobonds. In 2006, Seychelles became the first country in SSA (except South Africa), to issue bonds in 30 years time. After a year Ghana followed by raising $750 million. Since then Gabon, Senegal, Côte d’Ivoire, D.R. Congo, Nigeria, Namibia, Zambia and recently Kenya have joined them.

Attracted by the prevailing low interest rates, cash-strapped African countries looking to borrow money on international private markets are increasingly turning to Eurobonds. In 2006, Seychelles became the first country in SSA (except South Africa), to issue bonds in 30 years time. After a year Ghana followed by raising $750 million. Since then Gabon, Senegal, Côte d’Ivoire, D.R. Congo, Nigeria, Namibia, Zambia and recently Kenya have joined them.

Africa’s largest economy, Nigeria, entered the markets in 2011 with a 10-year Eurobond. In September 2012, Zambia made a splash on the international private market, launching a 10-year bond at $750 million. Rwanda followed suit in 2013 with a $400 million Eurobond. Kenya made a heavily oversubscribed inaugural debut in June to finance infrastructure projects raising $2 billion. According to Moody’s, a global credit rating agency, African countries raised about $8.1 billion in 2012. Financial Times reports investors placed orders for more than $8 billion showing the strong appetite for frontier market bonds.

What are the benefits?

The main benefits of international sovereign bonds are capital expenditure financing, benchmarking and raising visibility with a larger pool of international investors. In 2007, Ghana used bond proceeds to finance energy and transport projects. The proceeds of Senegal’s $500 million Eurobond issuance let the continued construction of a major highway and the upgrade of its energy infrastructure.

Sovereign bond issuance is usually the first step for a country’s wider access to private capital as it provides a benchmark for other national issuers and acts as a indication point in the appraisal of country risk for international investors. Benchmarking for the corporate bond markets is the most important development that African economies are experiencing. For example, following the inaugural $750 million Eurobond from Ghana in September 2007, Ghana Telecom placed a $200 million issue in the international market two months later.

Countries in SSA that issue inaugural bonds to raise at least $500 million will be qualified for inclusion in JP Morgan’s Emerging Market Bond Index (EMBIG). This elevates their visibility with a larger pool of investors and set a benchmark yield for local corporations and banks that desire to issue internationally.

Although some countries were able to issue 10-year paper or above, long-dated issue remains rare, thus most debt remains constrained at one year or below. The absence of a long yield issue in these countries is attributed interest rate and inflation volatility, public finance risk and lack of demand from investors.

Is it sustainable?

Whether this borrowing spree is sustainable in the medium-to-long term is open to question. The low interest rate environment is e expected to change in near future thus raising borrowing costs and reducing investor appetite. The current fast economic growth may not continue making it harder for African countries to service their loans. Furthermore, political instability in some countries could also make it harder for both borrowers and lenders. Political instability is also a factor that could put a twist in the whole process, reducing economic growth and increasing interest rates.

In a commentary entitled “First Borrow,” Amadou Sy, deputy division chief at the, points to recent sovereign defaults such as; the Seychelles default on a $230 million Eurobond in 2008, after a sharp fall in tourism and Côte d’Ivoire’s missed $29 million interest payment in 2011, after election disputes forced it to default on a bond issued in 2010. Government issuers also bear exchange-rate risk on the service of foreign currency debt. If repayment of the bullet maturity of the Eurobond coincides with a sharp depreciation of the exchange rate, the fiscal cost of repaying will be even higher.

Ethiopia – Reasons and Prospects

Ethiopia, Africa’s fifth biggest economy and one of the fastest growing frontier markets, is to become the latest entrant into international capital markets. Ethiopia attained its first sovereign credit rating in May, in which the popular rating firms Standard & Poor (S&P), Moody’s and Fitch rated her creditworthiness as B, B1(B+) and B, respectively. The ratings put Ethiopia in the same cluster with other strong African economies such as Kenya, Ghana and Zambia. Following this, she announced to make her maiden sovereign bond debut of a 10-year note by early January. Reports show that the government carried out preparations including the selection of three international banks (Barclays, Citi and BNP Paribas) that will help to select firms that will sell the bonds on behalf of the government and also a French advisory firm, Lazard Ltd.

The bond proceeds are expected to provide financing for her various infrastructure projects (such as roads, airports and railroads) and especially projects that IFI’s have been unwilling to finance like the Great Ethiopian Renaissance Dam (GERD). This in turn reduces the domestic borrowing pressure on the economy. The expected successful issuance will make Ethiopia eligible for inclusion in JP Morgan’s Emerging Market Bond Index (EMBIG) raising her FDI visibility and set a benchmark yield for local corporations such as EthioTelecom and EEPCo that may wish to issue internationally.

According to Moody’s analysis, only a few countries could raise a $500 million Eurobond internationally without distorting their economic and financial equilibrium, issuance representing below 5% of GDP, and a debt increase below 10%.. In Moody’s estimate, of a hypothetical $500 million Eurobond issuance would represent 1.1% of Ethiopia’s GDP and a debt increase of 4.7%, which will be 7.1% of general government revenue.

Strong economic growth and a low total debt to GDP ratio of 51.6% relative to western nations put Kenya in a strong position in its heavily oversubscribed maiden Eurobond issue in June in which she raised $2 billion, the largest debut for an African nation. This came in spite of a terror attack that killed 48 people. Analysts suggest expected 2014 GDP growth of about 5.8 % might have prompted investors not to ask for a much higher yield than the 6.875% interest Kenya offered for its 10-year paper.

With a total debt to GDP ratio of 35% and an expected 2014 GDP growth of 9% (Fitch Ratings), Ethiopia is expected to achieve similar success. Julians Amboko, a research analyst at Stratlink Africa believes Ethiopia is better positioned than many SSA countries because of its debt to GDP ratio of 35%, which is much lower than Kenya’s 51% and its budgetary structure that makes it a lot more debt reliant than Kenya and therefore, could easily surpass the one billion mark in its maiden debut.

http://hornaffairs.com/en/2014/10/14/ethiopias-foray-into-intl-capital-market-lessons-from-Africa/

.

World Bank Floats New Infrastructure Financing Facility for Developing Regions

.

VENTURES AFRICA – At the 2014 IMF/World Bank annual meeting in Washington DC, the World Bank group has launched a Global Infrastructure Facility (GIF) in order to provide financing in the realms of billions of dollars for the developing world.

.

The facility spearheaded by the World Bank will actually be executed in partnership with a whole ecosystem of asset management and private equity firms, commercial banks, pension and insurance funds, and multilateral development institutions. Some of these partners include the Asian Development Bank (ADB), European Investment Bank (EIB), the government of Japan and Singapore, the Nigeria Sovereign Investment Authority (NSIA) which manages the Sovereign Wealth Fund and 23 others.

Mr Jim Yong Kim, World Bank Group President, was impressed at the participation of the numerous institutional investors indicating that it was a breath of fresh air for developing nations who had seen investment in their infrastructure drop from $186 billion to $150 billion from 2012-2013.

“We have several trillions of dollars in assets represented today looking for long-term, sustainable and stable investments. In leveraging those resources, our partnership offers great promise for tackling the massive infrastructure deficit in developing economies and emerging markets, which is one of the fundamental bottlenecks to reducing poverty and boosting shared prosperity,” he said.

However, he emphasized the need for commercially viable and bankable projects saying; “The real challenge is not a matter of money but a lack of bankable projects – a sufficient supply of commercially viable and sustainable infrastructure investments.”

A group of other stakeholders and partners expressed their optimism at the wealth of opportunities that can be made available to the developing world via the new facility. Speaking on behalf of them, Joe Hockey, Australian Treasurer and Chair of the G20 Finance Track said; “We all recognize that investment in emerging markets and developing economies will expand access to basic services and raise living standards. It also helps to underpin economic growth. The G20 looks forward to working closely with the World Bank Group and other multilateral development banks on such vital innovations.”

According to the World Bank Group’s CFO, Bertrand Bader, the GIF would start a pilot phase later this year aimed at delivering complex public-private infrastructure in low and middle income countries.

http://www.ventures-africa.com/2014/10/world-bank-floats-new-infrastructure-financing-facility-for-developing-regions/

.

Bole Int’l airport expansion vital: Star Alliance

.

![]()

It’s imperative to build a new airport in Addis Ababa but until then the current one should be upgraded without delay, according to Star Alliance CEO Mark Schwab. The capacity of the existing airport is saturated and cannot accommodate the rapidly growing venture of Ethiopian Airlines as well as other carriers passing through the Addis Ababa Bole International Airport, he said.

Ethiopian Airports Enterprise is currently upgrading Bole International Airport at a cost of USD 250 million.

Schwab told Capital in Frankfurt, Germany, that after the new airport is ready however, the current Bole International Airport should not be used as a second airport as it will not be economically viable to operate both of them.

Three places are slated for potential new airport construction, Dukem, 25 Kilometers East of Addis Ababa; Mojo 75 Kilometers East of Addis; or Teji 30 Kilometers West of Addis.

When asked why it was necessary to make a USD 250 million expansion at the Addis Ababa Bole International Airport, if it is going to be idle when the new airport goes operational, the CEO said that the current expansion project is vital for the growth of the industry and the city too.

“One air plane nowadays costs about USD 200 million and when you have a lot of those planes on the ground; the money spent on the expansion is relatively low when compared to what the expansion will bring in terms of revenue for the city,” he said.

“A study made 15 years ago showed that Chicago’s O’Hare International Airport generates some USD 22,000 for the city every time a plane lands; so the expansion is beneficial not only for the airline but for the city too,” the CEO explained.

The Star Alliance CEO was in Addis Ababa recently to meet with Ethiopian Airport Enterprise and Ethiopian Airlines officials to discuss the new airport expansion project. One of Star Alliance’s services to its members is to consult and support new construction and improvement projects of airports and hubs so as to build in a collaborative manner a facility focusing on a seamless travel experience for passengers.

Meanwhile, Star Alliance plans to introduce its seamless hub project in Addis Ababa next year, which involves facilities such as common check-in facilities for Star Alliance members with high components of self-service; and a ‘smooth transfer experience’ for transit passengers.

Ethiopian Airlines joined the Star Alliance group in 2011.

The new expansion project of the Addis Ababa Bole International Airport, already underway by the Ethiopian Airports Enterprise will triple or even quadruple the terminal’s capacity.

The expansion project includes the construction of a new passenger terminal as an extensions of the existing Terminal 1 (domestic and regional terminal) and terminal 2 (international terminal) as well as the construction of a new VIP passengers’ terminal.

A USD 250 million loan for the project has been obtained from the government of China, and the agreement has been signed by the Ethiopian Ministry of Finance and Economic Development and the Chinese government. The Chinese construction company, China Communications Construction Company (CCCC), is undertaking the expansion project.

The French company, ADPI formed in 2000 as a subsidiary of Aéroports de Paris, is consulting the expansion project. ADPI’s landmark projects include Terminal 3 at Dubai International Airport, the final assembly line factory complexes for the Airbus A380 at Toulouse and the A400M at Seville, the passenger terminal extension at Bogota Airport. The design work of the expansion project was done by a Singapore company, CPG and the project is expected to be completed within three years.

In a related development, Star Alliance has begun to migrate the operations of member airlines of the alliance to the new Terminal 2 at Heathrow Airport in London, where it built the Star Alliance Hub Airport.

Star Alliance has built one of the most modern airport hubs in London, with 23 of the Alliance airline members, will migrate their operations to this hub at Terminal 2 until the 22nd of October; 14 carriers including Ethiopian Airlines have already joined the new terminal.

The Star Alliance is the world’s largest global airline alliance, headquartered in Frankfurt Main, Germany. It was founded on May 14, 1997 and the 27 current members have more than 18,500 daily departures combined. These flights reach 1,316 airports in more than 192 countries, with an annual number of more than 637.6 million passengers, representing 24.4% of the global travel market.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4633:bole-intl-airport-expansion-vital-star-alliance-&catid=35:capital&Itemid=27

.

MH Gets 40m Br Contract to Design Ethiopia’s Largest Stadium

.

- The tender was announced two years ago, but was delayed following complaints from bidders

.

![]()

Adey Abeba the first stadium in its kind.

.

![]()

The interior design and night time view of Adey Abeba Stadium.

.

![]()

Exterior grounds and main entrance view

.

The Federal Sports Commission (FSC) has awarded a close to 40 million Br contract to MH Engineering Plc for the design, supervision and contract administration of a new stadium, which will accommodate 60,000 people – double the capacity of the National Stadium.

The agreement was signed by Messle Haile (PhD), MH’s general manager, and Sport Commissioner, Abdisa Yadeta, at a ceremony held at the Kuriftu Resort in Bishoftu (Debre Zeit), on Monday, October 7, 2014. The contract includes 24 million Br for design and a 640,000Br monthly fee for at least two years while the construction lasts – amounting to at least 39.3 million Br.

The tender was announced two years ago, but was delayed because of complaints from bidders over the outcome of the tender. Three out of the seven bidders were selected on architectural creativity; these included JDAW Consulting Architects & Engineer, Yohannes Abey Consulting and MH. MH emerged as the winner in both the technical and financial evaluation.

The new Adey Abeba stadium, which could cost around two billion Birr, according to Tibebu Gorfu, facility director at the FSC, will be built on the grounds of FCS Sports Academy, along the ring road near Bob Marley Square at the old Imperial Hotel. The Sports Academy rests on 67ha of land, with 30ha already dedicated to the construction of a swimming pool, volleyball field, basketball field, football field and other additional facilities.

So, the remaining 27ha will be used for the new stadium. The whole plot was given to the Commission by the government for the success of the Ethiopian football team in the tenth African Cup of Nations in the 1980s.

“The project will be wholly financed by the Ethiopian government, and we have already received 205 million Br for initial works, before the construction begins,” said Tibebu.

MH will finalise the design by February, Messele says. It will be the first Ethiopian stadium built to fulfil the requirements of FIFA (Fédération Internationale de Football Association) and the IAAF (International Association of Athletics Federations) for World Cups and Olympic Games, says Messle.

According to the document – FIFA: Technical Recommendation and Requirements for Football Stadiums – such stadiums built for hosting World Cup final games should have at least 60,000 seats, parking spaces for 10,000 cars and a 100sqm warm up area for each team.

“Other additional requirements are related to the safety of the spectators, surveillance, the technological inputs needed for the stadium, space that has to be left for different stakeholders and other general requirements,” said Messle. “MH Engineering’s design will be conducted in accordance with this document.”

MH Engineering Plc, established in 1997, has previously been engaged in the design, supervision and contract administration of stadiums in Bahir Dar, Gambella, Assosa and Nekemte. The Bahr Dar Stadium is now the largest in Ethiopia, with 50,000 seats. The company has also conducted more than 400 buildings and 15 road projects over the past 10 years, according to its website.

http://addisfortune.net/articles/mh-gets-40m-br-contract-to-design-ethiopias-largest-stadium/

.

Gibe IV, V: next national projects

.

![gibe3]()

Ethiopia is trying to finance the construction of Gibe IV and Gibe V hydro electric power projects that will have a combined generating capacity of over 2100 MW as part of a series of cascade dams on the Gibe River. Sources told Capital that the feasibility study of the two power plants is being finalized and the government is looking for financers for the project that will consume billions of dollars.

The projects that will be managed by the Ethiopian Electric Power will have a generation capacity of 1470 MW (Gibe IV) and GIBE V will have a capacity to generate 660 MW.

“These two dams will be the next big projects of the country right after the commissioning of Gibe III which does have a generating capacity of 1870 MW,” sources said.

The Gibe III hydropower project is now more than 80 percent complete. It is expected to start generating power early next year, when its first turbine becomes operational. The other nine turbines will be installed and become fully operational by April 2016. The power house of the project contains 10 units each having a capacity of producing 187 MW.

The Gibe III Hydro-power project, with its potential to double the current electric power generating capacity of the country, is a key part of Ethiopia’s 5-years Growth and Transformation Plan (GTP).

The financial costs of the dam and hydroelectric power plant have been estimated to be 1.55 billion Euros. The cost of a transmission line from the power plant to the nearby Wolayta Sodo Substation has been estimated at 35 million Euros.

Gibe III when completed, will supply power need for neighboring countries such as Kenya with cheap power.

Currently Ethiopia is building Africa’s largest dam (The Grand Ethiopian Renaissance Dam) on the River Nile, which is a controversial issue between Ethiopia and Egypt. GERD when commissioned will have an installed generating capacity of 6,000 MW.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4634:gibe-iv-v-next-national-projects&catid=54:news&Itemid=27

.

Ethiopia eyes $2.5bln revenues of agricultural exports

.

![aginvest]()

Ethiopia is planning to earn a total of over $2.5 billion revenue from its exports of agricultural products during the current budget year, which began in July, an official with the Ministry of Trade said on Sunday.

“The stated amount of revenue will be secured from the export of more than 1.1 million tons of agricultural products,” Abdurrahman Se’id, Public Relation Deputy Head of the Ministry, told Anadolu Agency.

He said the products include coffee, oil seeds, cereals, khat, spices, natural gum and incense among others.

“The revenue is projected to surpass by 16.3 percent that of the $2.1 billion income earned during the previous budget year,” he added.

The target is taking into consideration the growth of agricultural products, market system efficiency, capacity of the exporters and suppliers of the products, he said.

The biggest export item will be coffee followed by oil seeds, Se’id said.

Around $862 million of the total revenue is expected from the export of coffee, which contributes the lion’s share in the country’s economy, he said.

“The country will also export 362,422 tons of oil seeds and secure over $724.8 million revenue in this fiscal year,” he added.

Coffee is believed to have been first discovered in Ethiopia’s south-west region of Kaffa/Caffa, with its name derived from the region.

Africa’s largest coffee producer, Ethiopia generated some $718 million from coffee exports during the 2013/14 financial year.

http://www.turkishweekly.net/news/173383/ethiopia-eyes-2-5bln-revenues-of-agricultural-exports.html

.

Ethiopia: Agriculture to industry

.

Chief Economic Advisor to Ethiopia’s Prime Minister, Neway Gebreab talks to CNN about creating economic opportunities.

Video link here http://www.msn.com/en-us/news/world/ethiopia-agriculture-to-industry/vi-AA6LLfc

.

Government Set to Buy Two Million Quintals Milling Wheat

.

![]()

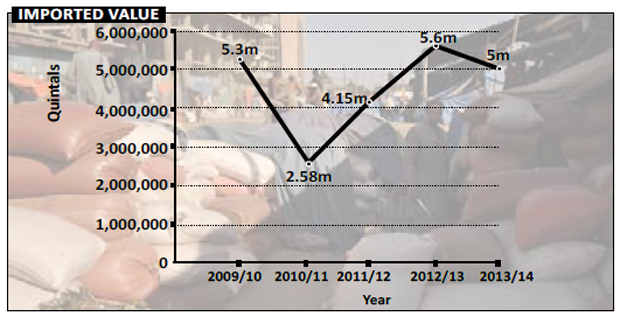

The amount of money that was spent to import five million quintals of wheat during the 2013/14 fiscal year is not yet calculated by the EGTE.

![]()

The 6.5 million quintals of wheat planed to be import during this fiscal year exceeds the last five consecutive year’s imported amount.

![]()

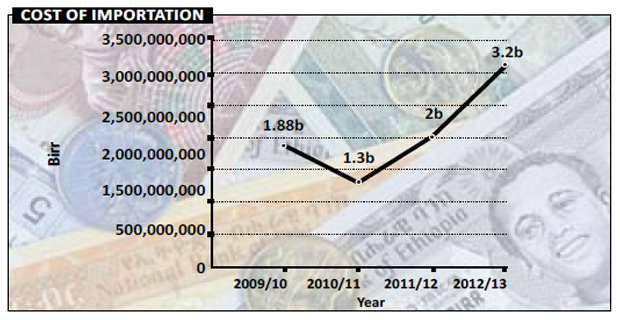

The country’s expense to import wheat increased from 1.11 billion Br in 2009/10 to 3.2 billion Br in the 2012/13 fiscal year.

.

So far the EGTE distributed 1.2 million quintals of wheat all over the country up to last Friday October 10, 2014.

The latest procurement leaves only 500,000ql for the plan in the year

The government is importing two million quintals of milling wheat, in addition to the four million quintals it has already bought by the beginning of the current fiscal year, leaving only 500,000ql for its plan for the year.

Public Procurement & Property Disposal Service (PPPDS), on behalf of the Ethiopian Grain Trade Enterprise (EGTE), announced the international tender to buy the wheat three weeks ago on the state-owned daily newspaper, The Ethiopian Herald. Financial opening is expected to take place on October 22, 2014.

The government has been importing varying amounts of wheat for years for market stabilisation purposes. In 2009/10, it had imported 5.3 million quintals, then nearly half, 2.58 million the following year. In 2011/12 and 2012/13, the imports were 4.2 million and 5.6 million quintals, which again was slightly down to five million quintals in 2013/14.

The price per quintal at which the government bought the wheat has also increased from 353 Br in 2009/10, to 507 Br, 534 Br and 549 Br through consecutive years until 2012/13.

At the global market, the price of the wheat is estimated to be 468 Br per quintal on October 9, 2014, according to USDA Market News.gov, a United States based website. Accordingly, the latest order could cost the government somewhere around 936 million Br. Nevertheless, the first batch of wheat the government bought this fiscal year has cost 600 Br a quintal excluding transport cost.

Following the problem of wheat shortage in the local market, the government bought four million quintals of milling wheat from Ukraine for 2.4 billion Br. The government made the order to six companies.

As of October 10, 2014, the EGTE has received 2.1 million quintals, which is stored at the central warehouse between July 29, 2014, and October 7, 2014. So far the EGTE has distributed 1.2 million quintals to 288 flour factories throughout the country, according to Etenesh Gebremichael, public relation & trade information head at the Enterprise.

![]()

The distribution takes place from warehouses at each regional capital every 15 days. These 288 factories supply flour to 5,000 bakeries identified by the Ministry of Trade and regional trade & industry bureaus.

In the first distribution for this fiscal year, between July 29 and August 19, warehouses at Addis Abeba and Mekelle were the biggest recipients, with 97,950ql and 89,598ql, respectively. Adama and Bishoftu had 47,787ql and 41,999ql, respectively, while Bahr Dar and Dessie each had 36,820ql.

The cost of the wheat to the government, including transport, is 776 Br, says Ali Siraj, state minister for trade. The government sells this to the mills at a subsidized price of 550 Br a quintal.

The mills make 73kg of flour of a quintal, according to Ali, which they sell to bakeries for 796 Br. A special consideration in Addis Abeba is that 4,520ql out of its biweekly quota of 113,000ql of mill will be distributed to people considered as lower income.

The government has been importing wheat with a total expense of 8.47 billion Br between 2009/10 and 2012/13. In the 2013/14 fiscal year, it had bought five million quintals during the last fiscal year for market stabilisation.

http://addisfortune.net/articles/government-set-to-buy-two-million-quintals-milling-wheat/

.

Ethiopia cuts extreme poverty, hunger by half

.

![]()

Ethiopia has achieved the MDG goal one, halving extreme poverty and hunger by 2015, the Ministry of Agriculture said.

Ethiopia is among the 63 developing countries have reached the MDG target.

Ethiopia is also among the 25 countries that achieved the more ambitious World Food Summit (WFS) target of halving the number of undernourished people by 2015.

The nation has managed to reduce undernourished people to 35 percent, which 20 years ago was 75 percent, the Ministry said.

The various activities being undertaken by the government to increase food security has contributed for the success.

According to the Ministry, Ethiopia along with the other countries will be honored at the 150th FAO Conference to be held in December.

The agriculture sector, growing by 8 percent in average is contributing for the overall development of the country and this achievement, the Ministry said.

According to reports, Ethiopia has made commendable progress towards reaching most of the MDGs. Apart from the overall decline in poverty, positive gains have been made in terms of education, health and reducing the prevalence of HIV and AIDS. These advances are owed largely to the Government’s efforts, with substantial support from the UN.

The State of Food Insecurity in the World (SOFI 2014) report issued by FAO confirmed a positive trend which has seen the number of hungry people decline globally by more than 100 million over the last decade and by 209 million since 1990-92.

The overall trend in hunger reduction in developing countries means that the (MDG) of halving the proportion of undernourished people by 2015 is within reach, the report said.

To date, 63 developing countries have reached the MDG target, and six more are on track to reach it by 2015.

http://www.waltainfo.com/index.php/explore/15456-ethiopia-cuts-extreme-poverty-hunger-by-half

.

Food, drinks, pharma sectors should generate more foreign currency

.

![]()

The Ministry of Industry was hoping to bring in USD 110.1 million from 48 major drug, beverage and food companies, however it only actually earned USD 68 million, 61.8 percent of the target, although it was 33 percent more than the year before. Twenty major companies exported food products bringing in a combined USD 59.7 million which is 79.6 percent of the target goals.

On the beverage sector, twenty-one major companies exported their products generating a revenue of USD 5.1 million while the target was USD 25 million, which is 20.7 percent of their target. The pharmaceutical sector is also another disappointment. The sector generated USD 3.1 million, 31.2 percent of the expected target which was USD 10.1 million.

Mebrhatu Melesse, state minister of Industry says things should improve with better infrastructure land management and testing laboratories to attract foreign investors. He added that change does not occur over night and that with wise investment more money will begin coming in.

“Some things, like global market prices, are not controllable. Other things like improving the power supply and lessening bureaucracy are controllable,” he said.

The state minister added that his ministry is taking a holistic approach to improving the export situation. Elias Genet exports oil seeds, one issue he points to is farmer’s need to get a fair price for their labor. He says that because food prices have gone up it is hard to attract investors. Mulat Abegaze exports sesame and he said that when companies fail more assessment should be done to improve the business climate. Previously Ethiopian Airlines discounted transportation for horticulture to improve that sector and some wonder if this could also be done for the food and beverage industry.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4629:food-drinks-pharma-sectors-should-generate-more-foreign-currency-&catid=35:capital&Itemid=27

.

Hibret Manufacturing Moves with Brakes On

.

- MetEC’s company plans to substitute import and to export different brakes for vehicles

![]()

The new brake factory will be the sixth factory which is incorporated under Hibret Manufacturing and Machine Building Industry which are engaged with manufacturing of machineries and spare parts.

.

Hibret Manufacturing & Machine Building Industry (HMMBI) is going to manufacture brake at a new 350 million Br plant at Awash Arba town in Afar Regional State.

HMMBI, one of the 15 semi-autonomous and integrated manufacturing companies that are operating in nine different sectors under the Metal & Engineering Corporation (MetEC), is building the factory, which is 95pc complete, on a 40,000Sqm plot of land 240kms east of Addis Abeba, according to Mikael Desta, head of Corporate Communications at the MetEC.

The brake factory will commence production by the beginning of January 2015 by manufacturing three types of brakes, for both of local and global market, according to Mikael. HMMBI’s other factories produce industrial machineries and spare parts.

The brake factory will produce drum brakes, brake shoe, and disc brakes.

Production capacity of the factory is 1.3 million drum brakes, 792,000 brake shoes and 200,000 disc brakes, annually. The plan is import substitution, says Mikaeal. All the machines for the new factory have already been delivered from China, and installation is already underway at the factory.

Established in 1945 and incorporated into MetEC in 2010, Hibret is a family of six factories, including the new one. The new factory will have a total of 290 workers to manufacture the brake for all types of vehicles form automobile to the big trucks in three levels small, medium and large, according to Mikael.

It targets supplying the domestic and East African market in the near future, Mikael told Fortune.

http://addisfortune.net/articles/hibret-manufacturing-moves-with-brakes-on/

.

Tullow moves out staff, machinery

.

![tullow]()

.

- Calls exploration results “a nightmare”

The British oil company which is prospecting for oil in the South Omo basin of Ethiopia, Tullow Oil, is moving its staff and machineries out of Ethiopia.

At a consultative meeting on the Ethiopian mining sector jointly organized by the World Bank and the Ethiopian Ministry of Mines on October 7 and 8 at the Addis Ababa Hilton, Nick Woodal-Mason, country manager, Tullow Oil, said that his company is taking its staff and mining equipment out of Ethiopia. “After drilling four wild cat wells in the South Omo basin we found nothing. We found only clay. Geologically, the results are a nightmare,” Nick told the participants. The company has already released the well drilling rig.

Tullow Oil began prospecting for oil in the South Omo basin in 2011 after it bought a 50 percent stake from Africa Oil, a Canadian oil company. Africa Oil and Marathon Oil own 30 and 20 percent working interest in the South Omo basin respectively. Tullow drilled four exploration wells; Sabisa-1, Tultule-1, Shimela-1 and Gardim-1 but it did not find any oil and gas reserve.

Nick explained how Tullow decided to come to Ethiopia. “We came here after we discovered oil reserves in Uganda and Kenya. We got positive results in the Great East Africa Rift Valley. The rift system extends to Ethiopia. Our blocks are found in South Omo near the Kenyan border where we found hundreds of millions of barrels of oil. The decision to come to Ethiopia was good but it did not work out.”

According to Nick, 35 expatriates from Tullow’s Ethiopian office have already left and there are about only five expatriates who are still here dealing with logistics and customs issues. “By December we are all leaving Ethiopia and we will keep only a skeleton office for the coming two years,” Nick said.

Nick explained the complexity of the oil exploration project in South Omo. “The concession is found in one of the remotest places not only in Ethiopia but in Africa. It is located 1600km south-west of the port of Djibouti. It takes ten days for a truck to reach the concession from Galafi, the Ethio-Djibouti border, to our camp. It costs us 10,000 USD per truck for a one-way trip. This makes our exploration work very expensive,” Nick said.

He noted that the drilling work was the most challenging one due to well instability and the hot temperature, as hot as 200 degree centigrade underground.

Nick said Tullow Oil will provide all the petroleum data it collected from South Omo and Chew Bahir to the Ethiopian Ministry of Mines Petroleum Licensing and Administration Directorate. “We have done by far more than our commitments. So we are not going to do extra work in the coming two years until the exploration agreement expires.”

Experts of Tullow Oil are now recalibrating the basin based on the data collected from the wells. “There is evidence of source rocks in the wells. That is not to mean that they do not exist in the kitchen,” Nick said. “We could not find the source rock.” However, he said, the subsurface data required from wells was obtained. According to him, the worldwide statistics of success rate ratio in drilling wild cat exploration wells is one out of 11. “Unfortunately, our wells were some of the ten failures.”

Nick said the company is leaving behind the infrastructure it built in South Omo. “We are leaving behind the roads and bridges we built and the local persons we trained.”

Tullow oil spent 250 million dollars on the South Omo oil exploration project.

http://www.thereporterethiopia.com/index.php/news-headlines/item/2626-tullow-moves-out-staff-machinery

.

Ethiopia to Extend Tullow Oil Exploration Permit as Data Studied

.

By William Davison

Ethiopia will grant Tullow Oil Plc (TLW) an extension to its exploration license after the company reported “encouraging” results in its search so far, Mines Minister Tolesa Shagi said.

“We will definitely grant them because they’ve done so much and we appreciate whatever they’ve tried to do,” Tolesa said in a phone interview from the capital, Addis Ababa, yesterday. “We try to assist them as much as possible.”

Tullow, based in London, requested more time to analyze data from drilling and seismic surveys in southern Ethiopia, the company said yesterday in an e-mailed response to questions. Two out of four wells drilled by Tullow and partners Africa Oil Corp. (AOI) and Marathon Oil Corp. (MRO) in the past two years show they may contain petroleum deposits, it said.

“The hydrocarbon shows in the South Omo basin wells are indicative of a working petroleum system and therefore the acreage in Southern Ethiopia remains prospective,” it said. “We are currently examining the substantial volume of drilling and seismic data collected to decide our future exploration plans.”

The size of the concession in southern Ethiopia is 5.4 million acres, according to Marathon Oil’s website. Tullow is focusing on East Africa’s Tertiary Rift that extends into Ethiopia. It struck oil on the same formation across the border in neighboring Kenya in 2012.

Gas Deposits

No oil or gas is produced by Ethiopia, though there are an estimated 4 trillion cubic feet of natural gas deposits in its eastern Somali region where a unit of China Poly Group Corp. is working.

Tullow is moving almost all of its staff out of Ethiopia after no oil was found in the country, the Addis Ababa-based Reporter newspaper said Oct. 11, citing Operations Manager Nick Woodall-Mason. No more work would be done during the last two years of the exploration license, it said.

While staff in Ethiopia will be reduced during a drilling break, “suggestions that Tullow will leave only a skeleton staff in Ethiopia for the next two years are incorrect,” the company said yesterday.

http://www.bloomberg.com/news/2014-10-15/ethiopia-to-extend-tullow-oil-exploration-permit-as-data-studied.html

.

Ethiopia loses more than USD 90 mln due to rough gemstones export

.

![opals]()

.

Ethiopia is losing more than 90 million dollars annually because of the exports of rough gemstones, it was learnt.

At a two-day consultative meeting on the mining sector held on October 7 and 8 jointly by the World Bank and the Ethiopian Ministry of Mines (MoM) at Addis Ababa Hilton, gemstone manufacturers and exporters told participants that the country is losing a huge amount of foreign currency and jobs due to failure to process (curve and polish) gemstones.

Tewodros Sintayehu, managing director of Orbit Ethiopia PLC, said that instead of exporting processed gemstones the country is supplying rough gemstones to the international market. Tewodros said in 2012 Ethiopia exported 16,500 kg of gemstones, mainly opal, and earned only seven million dollars. “Had this been processed we could have earned more than 100 million dollars and created more than 1000 jobs for Ethiopian citizens,” Tewodros said.

According to Tewodros, due to the country’s failure to process and export the gemstones it is losing jobs to India, China and other countries. He said that due attention is not given to the gemstone production and export sector. “The sector should be recognized and supported by the government. It should be administered under the Ministry of Industry as it is a manufacturing work. A committee should be established that would undertake a study on the potential of the sector and how it can be supported. The members could be drawn from the Ministry of Mines, the Ministry of Trade, the Ministry of Industry, the Ethiopian Revenues and Customs Authority and the Ministry of Culture and Tourism. A gemstone cutting and polishing industry should be established. The government should recognize it as a new industry and provide the required support to the industry,” he said. Tewodros said that the sector should be given protection and support, financing and industry zone.

Nature has endowed Ethiopia with more than 20 precious stones. Ethiopia exports mainly opal to India, Europe and the US. Ethiopian opal is now dominating the international market. Previously, Australia was known for high grade opal. Now it seems that Ethiopian opal is more popular than the Australian opal. There are four types of opal found in Ethiopia. Most of the opal is coming from North Wello, Amhara Regional State.

Tamrat Modjo, artisanal mining and transaction coordinating director with the Ministry of Mines, said that the sector was not ignored. Tamrat said the Ministry of Mines was closely working with gemstone producers in different regions. “We are providing support to the artisanal miners and gemstone manufacturers. Three years ago we imposed a ban on rough gemstone exports. There are no adequate gemstone processors in the country. So the artisanal miners were unable to sell their rough gemstones. This caused serious social and economic problems. More than 50,000 artisanal miners especially in the North Wello region faced a serious financial problem. Then we were forced to lift the ban. Now we are trying to bring in foreign investors who can engage in processing gemstones here in Ethiopia,” Tamrat said.

He added that the ministry was looking at the opportunity that artisanal miners could acquire mining equipment through lease finance scheme. According to him, in the 2013-2014 fiscal year the country exported 25,000 kg of gemstones valued at 16 million dollars.

An expert from the Ministry of Mines said that there were no trained professionals in the sector. “We do not have gemology education in the country. We do not have a gemology laboratory. The government should give due attention to the sector like it does to the flower and manufacturing industries,” the expert said.

The Ethiopian artisanal mining industry employs more than one million people. The major types of gemstones found in Ethiopia include garnets, emeralds, rubies, and opals. Opal accounts for nearly 98 percent of the precious stone exports of the country. According to the World Bank, the artisanal and small-scale mining sector’s size and characteristics is poorly understood. Border dispute with mining companies, poor safety awareness and impacts on the environment were some of the concerns in the artisanal mining sector.

http://www.thereporterethiopia.com/index.php/news-headlines/item/2631-ethiopia-loses-more-than-usd-90-mln-due-to-rough-gemstones-export

.

China labeled worst performer in Aid Transparency Index

.

According to the 2014 Aid Transparency Index, China is said to be the lowest performing country when it comes to aid transparency. The country scored just 2 percent out of a hundred in all the indicators placed by the index.

The index uses 39 indicators; divided into those that measure commitment to aid transparency which includes three indicators and then those that measure the publication of information that includes 36 indicators.

In a high level meeting of the Global Partnership for Effective Development Cooperation that was held in Mexico this year, donors have reaffirmed their commitments to publish information to a common, open standard, incorporating the International Aid Transparency Initiative (IATI), an initiative that seeks to improve the transparency of aid, development and humanitarian resources in order to increase their effectiveness in tackling poverty.

This year’s report shows that, although some organizations have shown continued improvement, majority of them have not done the same and hence are lagging behind. It states that the average score for all organizations sits disappointingly low at just 39 percent and there is an increasing gap emerging between those at the top and those at the bottom of the ranking.

The organizations that were poorly ranked including; the UK Ministry of Defense, the French Ministry of Economy and Finance, Italy and the Japanese Ministry of Foreign Affairs, because they have not been publishing efficient data on there developmental activities.

Some of the information that has managed to be published is scattered across websites and it is difficult to connect the dots between the descriptive, financial and performance information related to individual activities, making the data difficult to use.

“This means that there is still a long way to go in obtaining a full picture of all development flows, without which development effectiveness and improved donor coordination will be difficult to achieve,” the report reads.

The top ranking agency with 91 percent score line is the United Nations Development Programme followed by the UK Department for International Development with 88 percent.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4626:china-labeled-worst-performer-in-aid-transparency-index&catid=54:news&Itemid=27

Filed under:

Ag Related,

Economy,

Infrastructure Developments,

News Round-up Tagged:

Addis Ababa,

Agriculture,

Business,

East Africa,

Economic growth,

Ethiopia,

Grand Ethiopian Renaissance Dam,

Investment,

Millennium Development Goals,

Sub-Saharan Africa,

tag1,

World Bank ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

%20Ltd.,%20Ethiopia%204.jpg)

Attracted by the prevailing low interest rates, cash-strapped African countries looking to borrow money on international private markets are increasingly turning to Eurobonds. In 2006, Seychelles became the first country in SSA (except South Africa), to issue bonds in 30 years time. After a year Ghana followed by raising $750 million. Since then Gabon, Senegal, Côte d’Ivoire, D.R. Congo, Nigeria, Namibia, Zambia and recently Kenya have joined them.

Attracted by the prevailing low interest rates, cash-strapped African countries looking to borrow money on international private markets are increasingly turning to Eurobonds. In 2006, Seychelles became the first country in SSA (except South Africa), to issue bonds in 30 years time. After a year Ghana followed by raising $750 million. Since then Gabon, Senegal, Côte d’Ivoire, D.R. Congo, Nigeria, Namibia, Zambia and recently Kenya have joined them.

![allana[1]](http://africapotashblog.files.wordpress.com/2013/05/allana1.jpg?w=379&h=255)

![ethiopia-new-rail-routes-design-2010[1]](http://africapotashblog.files.wordpress.com/2013/04/ethiopia-new-rail-routes-design-20101.jpg?w=466&h=323)