.

Ethiopia’s leap toward solar energy

Addis Ababa: March 24, 2015 –

Addis Ababa: March 24, 2015 – Ethiopia, a vibrantly growing economy attracting many investors, will need alternative sources of energy to sustain production and economic growth. It is out of these challenges the country is looking for more clean and renewable energy alternatives.

The country has embraced partnerships with different players in the field of solar energy. The most recent investment topped more than 600 million US dollars in solar power generation. The Ethiopian government, through Ethiopian Electric Power, signed a memorandum of understanding with a US based Green Technology Africa (GTA) to develop solar energy plants in the country. The deal will help Ethiopian Electric Power develop a 300 MW new solar project in Ethiopia – with the aim of helping the country hit its goal of expanding electricity capacity from the current 55% coverage to 75% by the end of 2015. These projects will be active in the Ethiopian cities of Dire Dawa, Kombolcha and Desse in the next six months.

Green Technology Africa has lauded Ethiopia for its efforts to find solutions for a greener country. This praise includes the support for organizations launched internationally by Ethiopians in the Diaspora who have acquired years of training and professional expertise and then choose to return back home to give back to their society.

As a landlocked country, Ethiopia faces a number of challenges getting imports into the country easily and effectively. With these challenges, the country has sourced alternative solutions in achieving cleaner energy sources. Why not do it ourselves?

The Metals and Engineering Corporation started an initiative of assembling Photovoltaic (PV) solar panels for the first time in Ethiopia. Solar panel production is under construction at Sendafa area in Oromia regional state, 40 km away from Addis Ababa with the aim of increasing solar panels and silicon element production. This plant is an expansion of the solar panel production factory in Tatek area, which is manufacturing more than 20MW panels per year. Upon completion the factory is expected to increase this capacity to 270MW panels. This will facilitate the nation’s initiative to provide electricity to rural areas. This access, remote from the grid system using renewable energy, is a strong direction for the green development strategies.

The nation continues to promote the use solar energy to replace fuel-based lighting among rural households and off-grid electrical needs. The solar energy project underway by the government is aimed to provide electricity to 25000 houses. A total of 150,000 people are expected to gain access to electricity through this project alone, with a capacity of generating 982 MW of power by the end of 2015. The Solar Panel Production Factory was established under the Ethiopian Power Engineering Industry in the Metals Engineering Corporation two years ago with the objective of producing solar panels and substitute the imports. One more project of many the country has in place to electrify the rural areas using renewable energy sources and minimize the use of fuel in order to obtain a green economy.

http://www.fanabc.com/english/index.php/news/item/2529-ethiopia-s-leap-toward-solar-energy

.

25 International companies to take part in horticulture expo

Addis Ababa: March 25, 2015 –

Addis Ababa: March 25, 2015 – Companies from Kenya, China, Turkey, Germany, Sweden, the Netherlands, Belgium, and others from the Middle East and Asia are going to take part in the expo which will be opened tomorrow.

Buyers from Russia, Germany, Sweden, the Middle East and other countries are also expected in the expo.

Ethiopia generated around 212 million USD from the flower sector in 2011/12. However, this level of achievement declined to 186.7 million USD in the 2012/13 fiscal year. It bounced back in 2013/14, earning the country close to 200 million USD.

The Netherlands, Germany, Saudi Arabia, Norway, Belgium, UAE, Japan, USA and France are major importers of Ethiopian flowers. The Netherlands consumes over 80 percent of Ethiopia’s flower.

Currently there are 46 local and 61 international companies engaged in the sector. Nine companies have been also established by joint venture.

A total of 1,426 hectares of land is covered with flowers, while fruits and vegetables are cultivated on 11,371 hectares.

.

Ministry Calls on Consolidation of Ethio-South African Trade

.

Addis Ababa March 23, 2015 –

Addis Ababa March 23, 2015 –

Though the trade volume of Ethiopia and South Africa has jumped over 145 million USD, the economic relation of the two countries should further be consolidated, the Ministry of Foreign Affairs said. This was disclosed at the opening of the Ethio-South African Business Forum that opened here today.

Foreign Affairs State Minister Dr. Yinager Dessie said the countries ought to further strengthen trade ties, particularly in trade, investment and tourism sectors. He stated that Ethiopia would provide support if South African investors engage in textile, leather and leather products, food and agro-processing sectors.

Yinager pointed out that land would be promptly provided for investors who engage in huge investment. Investors from South Africa will also be exempted taxation for not only new but old machinery they bring into the country, it was learned.

Ethiopian Ambassador to South Africa, Mulugeta Kelil said on his part 56 South African big companies have been engaged in Ethiopia following the series of briefings they were given in their country during the past years.

South African Foreign Trade Promotion Director, Dr. Julius Nyalunga said the untapped huge trade and investment alternatives and opportunities have attracted them to Ethiopia. The cooperation of the countries would not only boost trade ties but also helps them tackle the challenge jointly, he added.

.

Egyptian industrial zone allocated for investors

.

Addis Ababa, 23 March 2015 -

Addis Ababa, 23 March 2015 -

Trade and Industry Minister Mounir Fakhry Abdel Nour declared the allocation of an Egyptian industrial zone just outside Addis Ababa, Ethiopia, in a speech during the Egyptian-Ethiopian Business Forum on Saturday.

An Egyptian businessman, according to the minister, had previously submitted a request to Ethiopian authorities to delineate an area from which he could work, as well as obtain the necessary licenses to do business there.

According to Dailynewsegypt, the new industrial zone will serve as an area in which Egyptian and Ethiopian investors can launch joint projects.

The fifth Egyptian-Ethiopian Business Forum began on Saturday in Cairo and was organized by the ministry in collaboration with the Ethiopian Egyptian Business Council. During his speech at the opening of the event, Abdel Nour indicated that Ethiopian-Egyptian ties are witnessing significant progress on political and economic levels due to cultural and historical relations.

Abdel Nour also stressed the necessity in unifying efforts to support bilateral cooperation, providing facilities and achieving cooperation with the private sector in order to boost trade ties. The current trade volume for Egypt is US$200 million, but the country is aiming to reach $500 million within the next three years, thus an increase of $300 million in trade for that period.

Forty Ethiopian companies, along with Egyptian companies interested in the Ethiopian market, took part in the forum. The high participation rate demonstrates a desire to cooperate with Egypt, added the minister. He also praised efforts by the Ethiopian government to resolve the issues Egyptian investors face in Addis Ababa, thus encouraging more investment in the Ethiopian market.

Ethiopian Industry Minister Ahmed Abtew discussed several points at the forum, stressing the importance of preparing a joint framework for bilateral economic and trade cooperation on governmental and private sector levels. He also hopes to develop policies that will create a suitable atmosphere to launch partnerships among businessmen from the two countries.

Ahmed, in addition, praised efforts by his country’s government with regards to targeting economic progress. He indicated that the average Ethiopian economic growth rate was at double digit per year, over the past 10 years. He also expressed the desire to engage in more joint cooperation with Egypt in the trade, economic and investment fields.

Ayman Eissa, head of the Egyptian department of the council, said the forum is important in pushing cooperation in economic fields forward, especially in light of the two countries’ mutual interest in developing the partnership. Despite challenges facing bilateral cooperation, the private sector has had a prominent role in this area over the past few years, he added.

.

Ethiopia’s Capital Addis Ababa Gets 4G Internet Connectivity

.

.

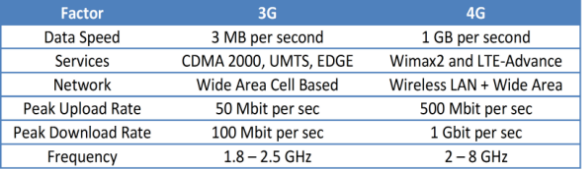

Ethiopia’s state-owned Ethio Telecom has rolled the fourth-generation (4G) mobile service in Addis Ababa. The 4G network is said to serve about 400,000 subscribers initially, with faster and more reliable internet speeds compared to the 3G network. Users will now be able to run more complex applications easily and fast.

.

.

The 4G network was made possible through a deal entered into by Ethio Telecom and two other Chinese firms; Huawei and ZTE. The deal came at a price tag of $1.6 billion and is set to roll our mobile infrastructure throughout the country. But the Ethio Telecom had a fall out with ZTE and replaced it with Sweden’s Ericsson on December, 2014.

According to a statement made by Ethio Telecom’s Head of Communications, Abdurahim Ahmed, the 4G network took eight months to set up. The Telecom says that the data plan charges will range from $21 per month for 2GB and $180 for 30GB.

However, as much as the move is to be appreciated, skeptics challenge the Ethiopian Government to be more effective in running Ethio Telecom more efficiently. Arguing a big part of Ethiopia, including the Capital, Addis Ababa, still has occasional patch mobile reception. The country is still one of the few countries in the continent where the Government monopolized and ran the telecom industry.

Government officials have made it clear, that Ethiopia is not even considering liberalizing the telecom industry. Saying the industry earns the government revenues that will be used in the ambitious construction of a 5,000 km (3,100 miles) railway lines by 2020.

http://innov8tiv.com/ethiopias-capital-addis-ababa-gets-4g-internet-connectivity/

.

Making Ethiopia a hub for investment

- .

Addis Ababa, 23 March 2015 -

Addis Ababa, 23 March 2015 -

The whole world has been witnessing the rapid economic growth of Ethiopia for over a decade.

Indeed, several economists and international media outlets have extrapolated that Ethiopia will soon be one of the largest economies in the continent of Africa as long as the country manages to keep its impressive and fast economic growth for the years to come.

Moreover, so often Ethiopia used to be a synonym with famine and war in the past, but these distorted and blemished images of Ethiopia have now completely changed. Currently, Ethiopia is getting well known for being Africa’s fast- growing – non- oil economy.

Due to the nation’s remarkable economic achievements, sustainable peace as well as security, a number of foreign investors and multinational companies have been showing great interests to invest in various economic and social sectors than ever before. In fact, some investors have already started doing business making use of the available attractive investment opportunities in the country.

Chinese shoe maker Hujian Group, Heineken and Unilever is but mention some of the largest and internationally renowned companies operating in Ethiopia.

Of course, Ethiopia is heavily investing on infrastructural development. For instance, railways and roads, which are believed to be strategical in the effort under way to provide reliable transport across the nation, are being constructed in integrated and timely manner by local and international contractors. To provide cheap power, there are ongoing dam projects like the Grand Ethiopia Renaissance Dam that with the capacity of producing a total electric power on par with that of six nuclear power stations.

Obviously, the palpable fast economic growth in Ethiopia is bringing about industrial -centric societies. This by itself will create huge market for multinational companies like Coca Cola coupled with the ongoing fastest urbanization and the ever rising income levels of the present estimated growing population of 94m.

Many reforms have been underway to improve the existing business registration, so that investors can secure their business licenses within a matter of few days as long as they fulfill the prerequisites to invest in this country. Hence, to further encourage investors to come and invest here, their requests need to be answered within hours or minutes through using latest technology.

Apparently, Ethiopia is currently attracting a huge number of international textile manufactures. Some of these manufactures have successfully set up their factories and hired local employees. Surprisingly, they are importing cotton despite the fact that the climate of Ethiopia is very suitable to grow cotton. Thus, the nation needs to encourage manufactures to grow huge amount of cotton for their own consumption and exportation purpose using Eco-friendly pesticides and high-tech technologies.

The government has to keep up building industrial zones and make sure that they get into the intended purpose as well. The manufactures that are supposed to set up factories in the industrial zones need to be acquainted with the benefit from a tax ‘ holiday’ of’ up to 17 years.

In summing up, the nation needs to work harder in attracting many more foreign investors and promoting its investment potentials to the rest of the world.

.

Ethiopia rides manufacturing boom

.

The government of the Federal Democratic Republic of Ethiopia has ushered in a manufacturing boom that is set to make the country a major regional player across several lines of products.

The widespread eagerness to invest is made that much more due to a large domestic market and an increasing number of skilled workers.

It is no wonder that some have dubbed Ethiopia as the ‘Bangladesh of Africa’ and with good reason. There has been tangible success already, with Chinese, Turkish and European garment manufacturers seeking to expand their operations.

.

However there are plenty of other areas worthy of attention.

The major manufacturing activities are in the production of food, beverages, tobacco, textiles and garments.

There are also opportunities in leather goods, paper, metallic and non-metallic mineral products, cement and chemicals.

Under the Growth and Transformation Plan (2010/11-2014/15), production of textile and garments, leather products, cement industry, metal and engineering, chemical, pharmaceuticals and agro-processing are priority areas for investment.

Thus there are ample manufacturing opportunities for prospective investors in the following areas:

– Textiles and clothing. Spinning, weaving and finishing of textiles from the beginning and the production of garments; manufacture of knitted and crocheted fabrics, carpets and sportswear and so on. The choice is yours.

– Food and beverage products; processing of meat and meat products, fish and fish products and fruits and vegetables. Investors can also delve into integrated production and processing of dairy products; manufacture of starch and starch products; processing of animal feed and processing and bottling of mineral water.

Other products to manufacture include sugar, brewing and wine-making, processing of pulses, oil seeds or cereals, manufacture of macaroni/pasta products.

– Tannery and leather products. You may decide to venture in the tanning of hides and skins up to finished level; manufacturing of luggage items; handbags, saddle and harness items. There is also footwear. Ethiopia’s footwear industry and leather sector in general enjoy significant international comparative advantages owing to the country’s abundant and available raw materials, highly disciplined workforce and cheap prices. Ethiopia boasts the largest livestock production in Africa, and the 10th largest in the world. Ethiopia annually produces 2.7 million hides, 8.1 million sheepskins and 7.5 million goat skins. This comparative advantage is further underlined by the fact that the costs of raw hides and skins constitute on average 55-60% of the production of semi-processed leather.

Ethiopia’s leather and leather product sector produce a range of products from semi-processed leather in various forms to processed leathers including shoe uppers, leather garments, stitched upholstery, backpacks, purses, industrial gloves and finished leather.

Ethiopian leather products have been exported to markets in Europe (especially Italy and the UK), America, Canada, China, Japan and other far eastern countries and the Middle East. Leather is also exported to African countries including Nigeria and Uganda.

– Glass and ceramics. This area includes tableware and sanitary ware, sheet glass and containers.

– Chemicals and chemical products. In this category is the manufacture of basic chemicals (including ethanol) using local raw materials which are plentiful. Other products that can be made in Ethiopia are fertilizer and nitrogen, soda ash, rubber, PVC granules from ethyl alcohol and caustic soda. We can add chlorine-based chemicals, carbon and activated carbon, precipitated calcium carbonate and ballpoint ink to the items already mentioned. Varnishes, soaps and detergents are other products easily manufactured in Ethiopia. There is a host of by-products from the chemical industry not forgetting pesticides and fungicides.

– Drugs and pharmaceuticals. This includes the manufacture of pharmaceutical medicinal, chemical and botanical products. These can come in the form of tablets, capsules, syrups and injectables

– Paper and paper products. Pulp from indigenous raw materials is readily available.

– Plastic products. Investors may choose to go into high pressure pipes or pipe fittings, shower hoods, wash basins, insulating fittings, light fittings, office and school supplies. The list is long.

– Building materials. There is room to invest in the making of lime, gypsum, marble, granite, limestone, ceramics, tubes, pipes and fittings. Amidst a building boom, you cannot go wrong going into this sector.

Lest you have questions; the Ethiopian Investment Commission can guide you every step of the way. The services include;

– Promoting the country’s investment opportunities and conditions to foreign and domestic investors;

– Issuing investment permits, business licenses and construction permits;

– Notarizing memorandum and articles of association and amendments;

– Issuing commercial registration certificates as well as renewals, amendments, replacements or cancellations;

– Effecting registration of trade or firm name and amendment, as well as replacements or cancellations;

– Issuing work permits, including renewals, replacements, suspensions or cancellations;

– Grading first grade construction contractors;

– Registering technology transfer agreements and export-oriented non-equity-based foreign enterprise collaborations with domestic investors;

– Negotiating and, upon government approval, signing bilateral investment promotion and protection treaties with other countries

– Advising the government on policy measures needed to create an attractive investment climate for investors

Source: Ethiopian Embassy in Uganda

http://www.busiweek.com/index1.php?Ctp=2&cI=10&pI=2994&pLv=3&spI=289&srI=77

.

Ethiopian government distributes 800,000 fuel-saving stoves

.

Addis Ababa, 23 March 2015 -

Addis Ababa, 23 March 2015 -

More than 800,000 fuel-saving stoves have been distributed to the public during the first half of the current Ethiopian budget year starting Sept 11.

The Ministry of Water, Irrigation and Energy said the move is a bid to minimise deforestation and improve public health.

Public relations and communications director at the ministry, Bizuneh Tolcha, said supplying households with the stoves would help to preserve 1,718 hectares of forest land.

Bizuneh told ENA Sunday the plan was to distribute 1.1 million stoves across the country during the current budget.

Supplying power-saving stoves is important to preserve Ethiopia’s forests since more than 90 percent of the rural population depends on wood for fuel.

“By supplying these stoves extensively, the ministry is working to halve the use of wood for fuel,” Bizuneh said.

The ministry is working with nine regional and two city administrations to produce improved stoves and supply them to households.

It hopes to supply eight million such stoves to the public and had so far distributed 7.3 million stoves to help protect more than 98,000 hectares of forest land.

.

Dangote to inaugurate East Africa’s biggest cement factory in Ethiopia

.

Aliko Dangote

Plans to invest on potash mine, cotton, sugarcane plantations

Africa’s richest person, Aliko Dangote, is going to inaugurate East Africa’s biggest cement factory he built in Ethiopia at a cost of 500 million dollars.

A subsidiary company of Dangote Industries Group, Dangote Cement Ethiopia PLC, built a state-of-the-art cement factory in West Shoa Zone, Adaberga wereda, near Muger town, 85 km west of Addis Ababa. The factory lies on 134 hectares plot of land has the capacity to produce 2.5 million tons of cement. Teshome Lemma, country general manager of Dangote Cement, told The Reporter that the fully automated factory is the biggest cement factory in the East African region. According to Teshome, the factory produces OPC, PPC and special cement for dam construction.

Construction commenced in March, 2012 and is completed in two years time in unmatched pace by any company in Ethiopia. This has prompted state minister of Industry Tadesse Haile to write a letter of appreciation to Dangote Cement Ethiopia some months back.

Dangote first came to Ethiopia in 2008 to venture into cement production when the Ethiopian economy was starving for cement due to a construction boom in the country. Back then the dearth of cement supply compelled the government to import the bulk product with hard earned foreign currency. This triggered the government to invite foreign and local investors to build cement factories.

Sinoma International Engineering, a giant Chinese construction firm, built the cement factory. Sinoma International is a leading cement factory construction contractor. The cement magnet, Dangote, who built cement factories in 17 African countries has personally been closely following up the progress of the construction flying his personal jet to Addis Ababa every two weeks. Surprisingly, he does not spend a night in Addis. Colleagues reckon that he only once spend a night at the Sheraton Addis after a tiring field visit to the construction site. “Usually he flies back to Nigeria the same day,” an employee of Dangote Cement Ethiopia said.

Teshome said all the machineries were procured from Germany, Sweden and Italy. “The factory has a state-of-the-art latest cement technology that is available in the world market today and it produces a world class cement that can be sold any where in the world,” Teshome told The Reporter.

Dangote Cement Ethiopia has imported mining equipment that mines the limestone and other raw materials from the quarry. It has installed automatic truck loading machines. “It is a robot that loads the cement on the trucks. We also use a robot technology to test the quality of the cement,” Teshome said.

The automated truck loading machine can load nine trucks at a time. It takes a truck only 15-20 minutes to enter the premise of the factory, load 800 sacks of cement and leaves the compound.

“The factory is environment friendly. There is no smoke coming out of the factory as latest pollution controlling technology is applied,” Teshome said.

According to Teshome, Dangote did not take any loan from local banks to build the giant cement factory. “He brought all the money from his coffer and he gives due attention to his investment project in Ethiopia.”

Ethiopian Electric allocated 40 MW of electric power to the new cement factory. The company constructed a 57 km power transmission line all the way from Sululta town to the project site. A Bosnian power company, Energo Invest, built the transmission line while ABB of Germany erected the power substation at the factory.

Dangote Cement Ethiopia will soon begin importing 500 trucks from China that will transport cement. Six of the trucks are bulk cement carriers.

The factory will be inaugurated after three weeks in the presence of Aliko Dangote and senior Ethiopian government officials. The test production is slated for March 29-April 2. According to Teshome, the factory will start channeling its products to the local market in end of April or in early May, 2015.

“We will offer the best quality product with competitive price. So we will not face any problem in the market,” the manager said. The factory will create more than 3000 direct and in direct jobs for Ethiopian nationals.

In addition to the cement factory, Dangote Group is looking into other investment opportunities in Ethiopia. The group has shown a keen interest to engage in potash mineral exploration and development project. Currently, Dangote Group is building Petro Chemical, Fertilizer and Oil refinery in Nigeria at a total investment cost of nine billion dollars.

The group needs potash mineral for the fertilizer factory. Accordingly, the group asked the Ethiopian Ministry of Mines for potash exploration license in the Afar regional State, a region known a vast potash deposit. According to company officials, the investment group also has an interest to develop cotton and sugarcane plantations in Ethiopia. The cement mogul arrived in Addis Ababa yesterday morning for routine visit.

The group owns Dangote Cement, Africa’s biggest cement company and number one cement supplier in Africa, Dangote Sugar Refinery, Dangote Industries and Dangote Oil Services. According to Forbes magazine, Dangote is worth 15.8 billion dollars.

.

Private equity in Ethiopia: Talking investment with Schulze Global

.

In 2008 Schulze Global Investments (SGI), an American investment firm and family office, became the first international private equity firm to open an office in Ethiopia. In 2012, SGI launched the Ethiopia Growth and Transformation Fund I, and completed a $86.5m fundraising process in 2014. The firm, headquartered in Singapore, has a presence in six countries including China, Brazil, Mongolia and Georgia. Dinfin Mulupi speaks to Blen Abebe, vice president at SGI Ethiopia, about closing deals in the Horn of Africa, and why similar funds are eyeing the market.

.

SGI was the first private equity fund to launch in Ethiopia. What factors motivated this move?

SGI is focused on emerging markets and has a history of investing in high-risk, high-potential markets. The first investment outside of the US was done in China several years ago at a time when people weren’t quite comfortable with that country. But in the case of Ethiopia, the Schulze family has a special connection to the country as the family has three children adopted from Ethiopia. As a consequence they visited frequently and saw the transformation so decided to invest their money here. Schulze Global, as a family office, invested in three companies prior to the Fund: a coffee roasting company called Tarara, a cement factory and an international school. And as investment returns were quite good despite the risky environment, they decided to raise a fund solely focusing on Ethiopia.

In which sectors do you see the most potential?

We are open to various sectors including agriculture, manufacturing, education, healthcare, real estate, and tourism. We see great potential in all of these sectors, but particularly in the FMCG sector due to its attractiveness associated with the growing population and rising disposable incomes. FMCG is also very attractive due to Ethiopia’s retail market potential. However, as a foreign entity, we can’t participate in retail outlets as it is prohibited to foreigners in terms of the Ethiopian Investment Proclamation. For example, with our coffee business we just sell to wholesalers and then they sell it to retailers. We cannot open our own retail outlets. Many people ask why we haven’t opened a Tarara coffee shop chain. That would have been great, but as a foreign company by law we may not.

Today more and more private equity funds are focusing on Ethiopia and even opening offices here. Economically, why does Ethiopia make sense?

I think Ethiopia is very interesting. Economically, the country has recorded double-digit growth for several years and the IMF expects that growth to continue. Culturally it’s also quite unique and the fact it has never been colonised makes it distinct in the way people interact and function. Ethiopians also store great value in relationships, so unless you change your mindset and learn how things are done here, it could be very challenging. In the West things are different as you can often do business without knowing the person you’re dealing with. But here, most businesses are family-owned so you have to be close to them to gain their trust.

So how has SGI been able to navigate this unique environment?

At Schulze Global, most staff are Ethiopian-Americans and the fact that you look Ethiopian and speak the native language ensures the locals can relate to us. For example, we have closed deals partly because we were on the ground and could relate better to locals than other private equity firms. And it makes sense, because most family businesses have been passed down through generations so they wouldn’t necessarily trust, or be willing to work with, you before they get to know you. That is why Schulze Global ensures it has people who know both the foreign and local culture.

What are some of the challenges SGI faces in Ethiopia?

Well, being the first one on the ground can have both positive and negative effects. For example, when Schulze Global opened its office back in 2008 most people had never heard of private equity. So we literally had to go through a teaching process of what it was we are doing. And to add to that, most companies confuse us with a bank so we must almost always explain the difference between a private equity firm and a bank.

After they understand the private equity structure, then the next challenge is agreeing to the terms that are in the term sheet. Especially since Schulze Global typically takes a minority stake, less than 50%, we have very strict minority protection rights in our term sheets. Some include compulsory sale, which means selling the entire company at the time of exit if we can’t find someone else to buy our shares. Imagine telling that to a local sponsor who has owned the business for generations. So all in all it is challenging, but all is possible with lasting patience.

Do you see in the future any likelihood of an exit?

We haven’t done any exits yet, but the future looks positive as we are seeing many entrants into the market. Therefore an exit via a strategic buyer should be attainable.

With more private equity funds coming in, how will things play out?

Competition is definitely increasing. We see it already. In fact, in one deal we are currently looking at, the sponsor is telling us they are also being courted by another fund. But our strength has always been that we have been in Ethiopia the longest, so we know what works and what doesn’t. And that long presence, even a small thing like knowing where our office is and the fact that they can visit us anytime, gives the local sponsors comfort – and at the same time gives us some leverage compared with other funds using the “fly-in and fly-out” model.

.

Authority issues urgent notice for transporters

.

As part of reducing the amount of stockpiled goods at the Port of Djibouti, the Federal Transport Authority has issued an “urgent” notice for transporters’ associations to report to the Galafi border town. According to the notice, transporters are required to transport goods as quickly as possible to ease the burden at the port.

According to the Authority, the urgency is instigated by the increasing shortage of some basic food items such as cooking oil and wheat in the local market.

Director of the Authority’s Communication Directorate, Abelneh Agidew, told The Reporter that the government had to issue such order because of the limited number of transport vehicles and trucks at the port.

He further told The Reporter that containers at the port are stocked with fertilizer, wheat and oil.

Sources at the Authority also told The Reporter that the stockpile would cost the country huge amount of foreign currency as demurrage fee in addition to its contribution for creating shortage of goods in the local market.

A year ago, Djiboutian officials informed their Ethiopian counterparts that the accumulation of Ethiopian containers was causing congestion at the Port of Djibouti, the country’s principal outlet for maritime trade with neighboring Ethiopia.

Ethiopian officials, on their part, said that the stockpile was created due to “capacity limitations” on the part of Ethiopian importers.

Recently, in an exclusive interview with The Reporter, Workineh Gebeyhu, Minister of Transport, said that delays with shipment trying to go out from the port is directly linked with the poor management system of transport vehicle owners.

He further indicated that the government is reviewing a mechanism on how to establish adept transport companies that could go hand in hand with the upgraded infrastructure.

The Port of Djibouti handle 800,000 units of containers per year and eight million tons of general cargo, according to recent data from the Ports & Free Zones Authority of Djibouti (PFZAD). Close to 20 percent of these containers and 85 percent of the general cargo is inbound to Ethiopia, where the transit cost claims close to one percent of the total cost of the goods, according to industry experts.

.

Laying of rail on the Sebeta – Meiso – Dewele project reaches 70%

Addis Ababa: March 21, 2015 –

Addis Ababa: March 21, 2015 – He added the two-phase construction of railway is progressing according to schedule. Currently, production and installation of electric polls, laying of rail tracks and construction of stations is taking place.

Expected to be inaugurated at the end of 2015, the project will reduce transportation time from seven days to just a few hours.

Sebeta – Dewele route, constructed by the Chinese C.R.E.C., is part of Ethio-Djibouti line and is 317 km long. Sebeta – Meiso, which is constructed by C.C.E.C., is 339 Km long.

.

Ethiopia’s first Crane and Lifting equipment factory to start production

Addis Ababa: March 21, 2015 –

Addis Ababa: March 21, 2015 – Mama’s cranes and lifting equipments have a 360 degrees capacity to lift and move building materials.

Major Bikila Bekana from Metals and Engineering Corporation’s Fabrication Industry noted the 400 million Birr factory is being set up in Debremarkos Town and has reached 75% completion rate.

Set on 180,000 meter square of land, the factory, based on current demands, will produce 100 cranes and 100 lifting units annually.

The factory will create several jobs, transfer technology and knowhow, tackle deforestation in connection with construction and reduce construction related accidents.

.

Ethiopia, Kazakhstan Interested in Bolstering Economic Ties

Addis Ababa: March 21, 2015 –

Addis Ababa: March 21, 2015 – President Mulatu Teshome met here Kazakh delegation led by the Special Envoy of Kazakhstan’s Foreign Minister, Ambassador Baghadad Amreyeu.

During the meeting the ambassador handed the message of President Nursultan Nazarbayev to President Mulatu Teshome.

The President at the occasion expressed Ethiopia’s desire to consolidate its trade and investment ties with Kazakhstan and its readiness to work with the latter in agriculture, mining, education and tourism sectors, among others.

He also appreciated Kazakhstan for deciding to open its embassy in Ethiopia and expressed his belief that the embassy would help the two countries to consolidate their relations.

Ambassador Amreyeu on his part told reporters that his country also seeks to work with Ethiopia in both international and bilateral concerns.

He stated that the opening of Embassy of Kazakhstan manifests the country’s desire to strengthen relations with Ethiopia.

Kazakhstan has a desire to strengthen its cooperation with Ethiopia in trade, investment, agriculture and education sectors, among others, the ambassador pointed out.

The embassy in Ethiopia is the third in Africa, after Egypt and South Africa.

Filed under: Ag Related, Economy, Infrastructure Developments, News Round-up Tagged: Agriculture, Business, East Africa, Economic growth, Ethiopia, Investment, Millennium Development Goals, Sub-Saharan Africa, tag1