.

Debate on Ethiopia‘s irrigation agriculture

By Andualem Sisay

In a sunny midday some 200 kilometers south east of the capital Addis Ababa, Huruta Dore town young motorbikes blow dust running up and down. They are the emerging new generation of well-to-do farmers of Ethiopia using irrigation.

Located in Arsi zone of Oromia region of the country, this semi desert town was known as drought area and the inhabitants used to rely on wheat aid. Today its over 500 hectares of land is covered with various crops and vegetables.

Thanks to the regional government who diverted the Awash River five years ago to pass through this town, it is no more desert.

“In those days it was difficult for our parents to be engaged in farming as they only get rain once in four or three years,” says Bedada Tufa, who now harvests half a million birr (around $27,000) produces every year from two hectares land using the water.

“They spent more of a pastoralist type life seeking water for their cattle. Today thanks for this government, who diverted this river to pass through our village, we have been producing crops and vegetables three seasons within a year for the past five years,” says Bedada who has six children at the age of 38.

A few hundred meters away from Bedada’s farm, about 80 farmers are busy collecting onions from 25 hectares. Most of them came from the central part of the country known as Amhara region. They are working for Debebe Belachew, who also came five years ago to work for another farmer when the news of Awash River diversion was herald.

They work with the owner of the farm like Debebe on profit sharing basis after all cost deduction including land rent. During good harvest one employee earns up to 60,000 birr per year ($320) from three seasons harvest.

“I am building a house in Adama (Nazreth) city investing over 2 and half million birr ($132,000),” says Debebe who is father of two kids. “In my account I have over two million birr ($105,000) and my plan is to expand the farm and recruit more people,” he says.

.

MoT to Take Measures Against Uncertified Importers

The Ministry of Trade (MoT) is set to take measures against importers who have not yet received a standard quality certificate from a third party. This is a requirement, put into place by the Ministry in July 2013, for the importation of 57 items.

The new directive obliges all imported goods that are included under the list of Mandatory Ethiopian Standards (MES) to be accompanied by a laboratory test certificate from an authorised international company.

The Ministry is set to take measures against the backlog of importers who continue to take goods without undergoing the necessary inspections, even after the issuing of the directive.

According to the new requirement, the importers of those identified materials are supposed to get quality and standards certificates from internationally recognised institutions, such as the Bureau of Veritas, Cotena and Société Générale de Surveillance (SGC), among others.

“The Ministry will automatically take measures against any failure to comply with the regulation,” Tamiru Geno, Import & Export Quality Control director at the MoT, told Fortune.

He said the Ministry made several attempts to give importers leverage on obtaining their certificates.

“But many of them have still failed to do so,” he said.

So far, the Ministry has warned about 40 importers over the materials they import, saying that they fail to meet the standards. Among the total of importers given warning, 10 are soap importers.

The measures apply directly to the importers of steel, corrugated sheets of iron and electrical servers, among others.

The Ministry says it has been giving training to importers, complaining, however, that the turnout has been poor.

“Recently, we invited 130 importers, but only 30 of them attended,” Tamiru claimed. “They are just forcing us to take measures.”

The measures might include the revocation of licenses, Fortune learnt.

The Ministry has the power and duty to check whether the importers are working with the set standards before providing them with a license.

In addition, the directorate is authorised to carry out assessments and arrange agreements with third party conformity assessment bodies abroad to conduct pre-shipment inspections.

The Ethiopian Conformity Assessment Enterprise (ECAE) helps the Ministry by checking the quality certificates through conducting surveys.

http://allafrica.com/stories/201312310051.html

.

Warring Factions of South Sudan Due to Addis for Talk Today While Ultimatum Comes to Draw

Delegates of South Sudanese warring parties are expected to arrive here in Addis Abeba later today, to start talks on the ongoing political crises, sources disclosed to Fortune. Delegates representing South Sudanese President Salva Kirr and his foe, Riek Machar (PhD), are coming to Addis Abeba to follow on the IGAD summit last week in Nairobi, which is trying to defuse an ongoing tension.

The political impasse between the President and his deputy, which the later claims is due to governance problems, led to the death of thousands of people (including Ethiopians) and displaced over 120,000 others. However, pundits see the conflict as mere power struggle between the two politicians, both of whom are veterans of the liberation struggle.

IGAD member countries, under the chairmanship of Prime Minister Hailemariam Desalegn, have given both leaders a four-day ultimatum to cease hostilities and start talks in overcoming the impasse.

The ultimatum comes to an end today.

.

Abay Bank Continues Aggressive Expansion With Impressive Annual Growth

- The bank will have to increase its paid-up capital by 20% a year to match the 500 million dollar directive

Clik here to view.

Tadesse Kassa, right, chairperson of the Board of Directors and Mesenbet Shenkut, president of the Bank.

Abay Bank, one of the new entrants into Ethiopia’s bourgeoning banking industry, jumped into the year 2013/14 with a robust performance. This came mainly as a result of a significant increase in interest and non-interest incomes.

Interest earned on loans, advances, National Bank of Ethiopia (NBE) bonds and deposits has increased by 107pc to 88.34 million Birr. Both domestic and external trade contributed to the success of the Bank. Mining and quarrying, building and construction, and transport and communications were activities that spurred the success in the export sector, according to the annual report of the Bank for the year 2012/13.

Non-interest income, such as commissions, service charges, gain on foreign exchange and other income has jumped up 82 million Br – an increase of 54pc.

Abay Bank was licensed by the Central Bank in July 2010, registering 157.8 million Br in paid up capital, mobilised from 823 founding shareholders. These include major ones such as Dashen Brewery SC (7.5 million Br), Amhara Water Works Construction Enterprise (7.5 million Br), the Housing Development Agency of the Amhara Regional State (7.5 million Br), the Amhara Design & Supervision Works Enterprise (7.5 million Br), the Amhara Region Urban Development & Construction SC (7.5 million Br), the Gozamen Farmers’ Cooperative (2.5 million Br), the Amhara Development Association (4.5 million Br), the Tikur Abay Transport SC (4.5 million Br) and Sebhatu & Sons Property Administration & Security Plc (one million Birr). The number of shareholders, which stood at 1,189 in the 2011/12 fiscal year, has swollen to 1,525, as of June 30, 2013 – when the year ended.

As a young entrant, Abay ploughed through the stiff competition characterising the industry with an aggressive expansion, which also involved human capital – almost doubling the total number of its employees from 275 to 478.

Abay had to endure high expenses to deliver its aggressive expansion. Thus, total expenses went up to 119.45 million Br. Interest expense increased by 83.4pc to 28.6 million Br and staff and general administration expenses shot up to 90.8 million Birr. All of the increases are higher than the industry average.

“The increase in expenses at such an alarming rate, while the industry profit is declining could undermine future profitability,” cautions Abdulmena Mohammed Hamza, an accounts manager for the Portobello Group Ltd – a London-based holding company. “Hence, cost control should be put in place.”

But the aggressive expansion of the Bank, according to its management, will continue into the 2013/14 fiscal year.

“Expansion of our branch network will continue to be the centre of our business development strategy,” reads the message of Tadesse (Tinkishu) Kassa, chairman of the board of directors, published along with the audited report.

Nevertheless, the Bank has devised a strategy to reduce the soaring expenses. It has pinned its hopes on constructing its own premises, cognisant of the staggering rent expenses it has incurred.

The Bank’s profit after tax has soared to 38.04 million Br and its Earnings per share (EpS) has gone up to 14.3 Br from 12.2Br.This staggering performance has been achieved while the industry profit has gone down by 2.4pc.

The total assets of the Bank have increased by 150.5pc to 1.951 billion Br. Abay has disbursed loans and advances of 843.1 million Br, which is 86.5pc higher than last year. The size of deposits have also expanded remarkably and reached 1.476 billion Br.The loan to deposits ratio of Abay has gone down to 57pc from 58.1pc. Loan to deposits ratio has declined for the second time in a row.

“Such declining trends should be reversed,” advises Abdulmena.

Abay has invested 374.46 million Br in NBE five year bonds. This investment accounts for 19pc of the total assets and 25pc of the total deposits of the bank.

Various liquidity ratios indicate that the liquidity level at Abay has declined considerably. Its liquid assets to total assets ratio has gone down to 26pc from 40.31pc and liquid assets to deposit ratio has decline to 34pc from 60pc. Such a decline is an industry-wide phenomena, due to the directive that compels private banks to invest 27pc of their loan disbursements into five year NBE bonds.

Abay increased its paid up capital by 21pc to 288.51 million Br and its capital adequacy ratio stands at 37pc, indicating that it is a well capitalised bank. To comply with the directive that compels private banks to have paid up capital Birr 500 million by 2016, Abay should increase its paid up capital by 20pc per year, says Abdulmena.

The three-year-old Bank plans to launch mobile and agent banking in the next year. Agent banking involves the use of a company that will provide transactional services to clients of a bank.

The use of agents will also benefit bank customers who will have easier access to their money from nearby shops, instead of travelling to branches.

The Bank plans to regulate the cash flow from the agents by holding a minimum of half a million Birr of their money as collateral.

The Bank is currently negotiating with nearly 100 agents nationwide, and plans to start giving the service as soon as the company gets the green light from the NBE.

.

Oromia International Bank Launches Interest-Free Banking

- The bank has planned to offer the service since its inception, but has had to wait for a Central Bank directive

Clik here to view.

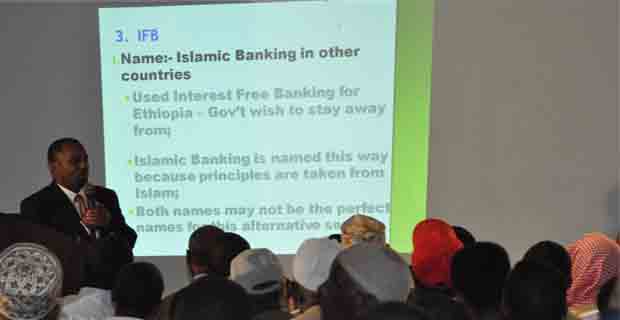

Abe Sano, president of Oromia International Bank, presented how the Interest-free Banking system works to the participants of the opening ceremony held at Elelle Hotel on Marshal Tito Street.

Clik here to view.

Abe Sano, president of the Bank, (right), and Nuri Hussein, acting director of IFB, checking their notes during the briefing session with bank customers.

The Oromia International Bank (OIB) became the first bank inEthiopiato launch interest-free banking (IFB), after the Commercial Bank of Ethiopia (CBE) on December 16, 2013.

The service, to expand in phases, has started in 24 of the bank’s 60 branches inEthiopia, Abe Sano, president of the Bank, said.

The Bank will offer saving (wadia) and current (amanah) account services, as well as equity financing (mudrabah), based on principles drawn from Islam. These principles include avoiding interest, gambling and uncertainty. All business should also be conducted in writing, and profits will be shared as agreed, but loss according to capital, Abe said in a presentation he made at a ceremony held at Elelle Hotel onMarshal Tito Streeton Wednesday, December 25, 2013, announcing the launching of the service.

“But since this is strictly business and not religion, we prefer to call it interest-free banking,” he said while talking about Islamic Banking, IFC’s other name.

The bank announced that it would start the service when it was established six years ago, in an attempt to reach potential customers who were not banking for interest-related reasons. It had to wait until the present time, however, because the Central Bank’s directive for the service only arrived in September 2013.

In this new banking service, the bank will not use depositors’ money for businesses considered haram.

In equity financing, the bank will provide the fund and the client (mudarib) will provide the labour. Profit will be shared as agreed, and loss will be borne by the bank; the mudarib being held accountable to the extent of identified negligence, according to Abe.

“We had to prove to the authorities that we had ample preparations,” says Abe, speaking after they acquired the license.

One of the preparations included ensuring that the core banking system installed by the Bank was convenient for launching the IFB service, which is offered online.

The Bank, which saw its profits increasing by 71.9pc to 77.5 million Br, according to its annual audited report for 2012/13, has deployed about 129 staff members in the 24 branches. Four staff from each of the selected branches consisting of branch managers, accountants, assistants and senior customer service officials, have received trainings in the implementation of the service.

Prime among the challenges the Bank expects to face while launching the scheme is the considerable time it may take for the scheme to sink into the minds of people.

“Creating awareness is essential,” Nuri Hussein, acting director of IFB with the Bank, said. “We will embark upon aggressive training and awareness creating schemes.”

This includes at least four conferences to be held in Addis Abeba. Similar events are also planned to take place in regional capitals.

The Bank will launch the service in three phases, the first of which has been in progress since December 16 and is expected to end in two months time. The second, which envisions pushing the number of branches offering the service up to 60, will commence anytime between May and the end of June 2014. The final phase will begin in July 2014, enabling all branches to offer the service.

A senior banking expert, who has worked for the regulatory body for over two decades, says launching the service is like forming an additional independent financial institution under the bank.

“The service provided is quite separate from the conventional banking system,” he said.

Establishing a Sharia advisory board and separate financial reports, keeping all data and ensuring the segregation of activities from conventional banking are some of the requirements to launch the program.

http://addisfortune.net/articles/oromia-international-bank-launches-interest-free-banking/

.

Ministry invites more private investment to tap agriculture potential

Ministry of Agriculture (MoA) said more needs to be done to attract private investors to engage in commercial agriculture to tap into the country’s huge potential.

In an exclusive interview with WIC, Tefera Deribew, minister of agriculture, said large scale commercial farmers in the country are registering ‘encouraging’ results but insisted a lot has to be done to ensure more success.

Ethiopia is touted as a nation with huge agriculture potential with diverse ecological zones suitable for various types of crops, abundant ground and surface water resources and cheap labor.

According to the ministry, Ethiopia’s potential arable land is estimated to be nearly 70 million hectares, out of which 12 million hectares have, so far, been developed.

“We have identified nearly 3 million hectares of arable land for potential foreign and local investors,” Tefera said.

With a view to tapping the huge agriculture potential, which contributes up to 43 percent of the country’s gross domestic product, the government is attracting large scale commercial farmers.

Foreign investors, mainly, from Asia and the Middle East, are engaged in large scale farming, particularly in the lowlands of the country where the potential remains largely untapped.

The minister admits the achievements gained so far from commercial farmers have not met government expectations but remains optimist of future success.

“We are witnessing introduction of new technologies and new crops which, in future, will help us develop the sector,” Tefera said.

With the country’s ideal geographical location to market destinations in Europe and Asia and a state owned world class airline with air cargo service dubbed among the fastest growing in the world, the ministry predicts bright future for country’s agriculture sector.

.

Ethiopian Aviation Academy Graduates 124 Aviation Professionals

Ethiopian Airlines, the fastest growing and the most profitable Airline in Africa, has graduated 52 Aviation Maintenance Technicians, 47 Marketing and 25 Finance trainees on December 26, 2103 at a graduation ceremony held at the airline’s Headquarters.

Tewolde Gebremariam, CEO, Ethiopian Airlines Group said, “Ethiopian is continuing to invest heavily in the training of skilled aviation professionals that are critically essential for the successful implementation of its fast, profitable and sustainable growth strategy. With the heavy investments the airline has made over the last 3 years, Ethiopian Aviation Academy now has 1,000 trainees’ annual in-take capacity in all critical areas of the industry such as pilots, cabin crew, aircraft technicians, Sales and marketing and finance personnel. Going forward, in line with our Vision 2025 strategic roadmap, Ethiopian Aviation Academy aims to quadruple its intake capacity by training 4,000 aviation professionals annually with a view to support the African aviation industry”.

Ethiopian Aviation Academy has recently been transformed into a profit center of the Ethiopian Airlines Group with the aim of making it the leading aviation-training center in Africa by 2025.

Ethiopian Aviation Academy provides training to pilots, aviation technicians, cabin crew, marketing and finance professionals and is certified by the Ethiopian Civil Aviation Authority, the U.S Federal Aviation Administration, European Aviation Safety Agency (EASA), and IOSA (IATA Safety Audit).

.

Related articles

Image may be NSFW.

Clik here to view.

Clik here to view.